回上

一頁

一頁

中華民國112年08月

Aug. 2023

Aug. 2023

信義房屋周董事長認同不動產買賣糾紛適合循仲裁機制解決Chairman Chou of Sinyi Realty Inc. Acknowledges the Advantages of Arbitration to Resolve Real Estate Disputes

112年8月18日本會吳理事長永乾偕同李秘書長天任拜訪信義房屋股份有限公司周董事長俊吉。吳理事長讚譽同為法律人出身的周董事長係令人欽佩的企業家,信義房屋堪稱不動產界之龍頭,如仲裁機制能獲得信譽卓著公司的支持,對推動仲裁機制定大有助益。鑒於信義房屋過往曾在其不動產委任契約書上約定循仲裁機制解決爭議,吳理事長與李秘書長除表達感謝信義房屋對本會與仲裁制度的支持外,也希望能透過本次拜訪探究該公司未於契約中續採用仲裁方式之原委。

吳理事長談及在台灣,因仲裁法係單獨立法,不像德國是規定在民事訴訟法裡;又因仲裁法不是大學法律系必修課程,甚至可能也不在選修課程中,導致大部分的法律人對仲裁欠缺深入的瞭解,即使如今仲裁已是全世界通行的紛爭解決制度。仲裁機制相較於民事訴訟,其優點:

1. 節省時間,仲裁一審終結,最長就是9個月,而訴訟三審三級,普通一件案子平均約4.5年。

2. 節省費用,姑且不論三審三級制之律師費用,單以標的金額而言,特別在標的金額越大的情況下,仲裁費用平均是標的金額的百分之零點6,而三審訴訟費用平均約為標的金額的百分之4點2。

3. 仲裁庭多數採合議制,至少其中一位仲裁人係當事人選任之專業人士,獨任仲裁人則須於雙方合意選任,相較法院之承審法官是隨機電腦分案,應更具可預測性及可信賴度。

4. 仲裁程序原則不公開與不得對外揭露,既維護企業與客戶的和諧關係,也保護企業良好形象,並舉近日報章所載台中市政府與興富發間之中捷案件為例。

周董事長回應本會理事長,其海外與大陸地區的投資爭議都採用仲裁機制為紛爭解決方法,並不清楚公司為何未將仲裁條款列入不動產委任契約書中,但推測或許係因業務人員面對不知仲裁為何之一般民眾,既不知該如何解釋仲裁與訴訟的不同,也不清楚該如何化解委託方因「機構效應」產生之信任疑慮,即企業較熟悉如何選任仲裁人,或者企業可能有御用仲裁人之擔憂。周董事長承諾會請公司內部再予以研究外,同時也指出仲裁機制應該更適合用於不動產買賣契約之買賣雙方當事人間的爭議,未來可協助將仲裁條款納入不動產買賣契約。

吳理事長當即對於周董事長所提「機構效應」選任仲裁人疑慮問題,以最近頗受社會關注之銀行與投資人間TRF爭議為例,本會採取對於同一類事件任一方當事人於三年內選任同一仲裁人超過3次以上應為揭露等措施以為因應外,也表示協會已陸續與臺灣省不動産開發商業同業公會、金門縣不動產開發商同業公會等合辦研習會積極宣導為何應以仲裁機制解決不動產的買賣糾紛,將儘速研擬適合不動產界用之仲裁條款送請信義房屋參考。

最後,周董事長更以其曾就讀世新、文化雙重校友身分,分與兩位前世新大學吳校長與前文化大學李校長交流請教關切學校近況與高教發展。

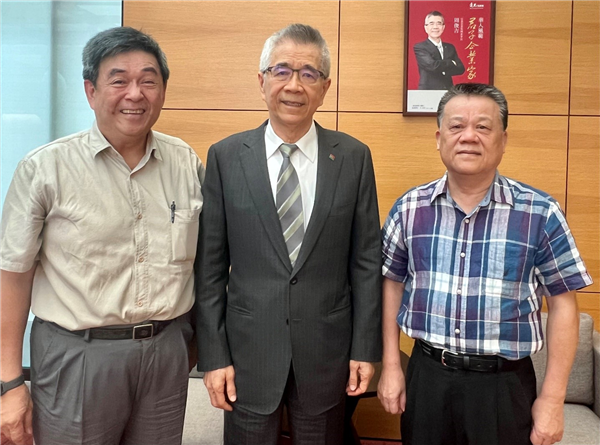

(左起)本會李秘書長天任,信義房屋周董事長俊吉及本會吳永乾理事長

(From the left) CAA Secretary General Dr. Tien-Rein Lee, Sinyi Realty Chairman Mr. Jun-Ji Chou and CAA Chairman Dr. Joe Y. C. Wu

(左起)本會李秘書長天任,信義房屋周董事長俊吉及本會吳永乾理事長

(From the left) CAA Secretary General Dr. Tien-Rein Lee, Sinyi Realty Chairman Mr. Jun-Ji Chou and CAA Chairman Dr. Joe Y. C. Wu

On August 18, 2023, a visit was paid by CAA Chairman Dr. Joe Y. C. Wu and Secretary-General Dr. Tien-Rein Lee to meet with Chairman Mr. Jun-Ji Chou of Sinyi Realty Inc. (referred to as "Sinyi Realty" hereafter). During the interaction, Chairman Wu lauded Chairman Chou's adept leadership within one of Taiwan's premier real estate companies. This acknowledgment held special significance as the promotion of arbitration was certain to benefit from the support of a distinguished establishment. Further, Chairman Wu and Secretary-General Lee expressed gratitude for Sinyi Realty's prior support of CAA and the arbitration mechanism, particularly through the integration of CAA arbitration clauses into their contracts. Their interest was aroused by the shift away from this practice and they sought to find out its cause for its discontinuance.

The reasoning behind this shift was illuminated by Chairman Wu, who highlighted the unique status of the Taiwan Arbitration Act distinct from the Code of Civil Procedure, a distinction not found in Germany. Additionally, arbitration law courses seldom offered in Taiwanese law schools contributed to a lack of familiarity with arbitration among legal practitioners. Notwithstanding these challenges, arbitration offered numerous merits over litigation, including:

1. Time efficiency: Arbitration, with its immunity to appeals, typically culminates within a maximum of 9 months. By contrast, the court-based litigation process involves three trial instances and an average time frame of around 4.5 years.

2. Cost-effectiveness: While litigation entails escalating attorney fees across three levels of courts, arbitration expenses remain relatively economical, hovering around 0.06% of the disputed amount. In comparison, litigation costs amount to roughly 4.2%.

3. Dependable Tribunal: The arbitral tribunal comprises arbitrators nominated by each party, yielding a more foreseeable and reliable outcome compared to the randomness associated with judge assignments in litigation.

4. Confidentiality: Arbitral proceedings maintain confidentiality, affording parties the opportunity to amicably resolve disputes while safeguarding corporate reputation—a facet illustrated by the Taichung MRT incident.

In response, Chairman Chou of Sinyi Realty shared that arbitration mechanisms had proven effective in resolving investment disputes on both the international and mainland China fronts. The omission of arbitration clauses from real estate appointment contracts, however, was yet to be fully elucidated. He surmised that staff might face challenges in elucidating arbitration to customers unfamiliar with the distinction from litigation. Moreover, concerns related to client trust in arbitral institutions and potential biases in arbitrator selection might have contributed to this shift. Chairman Chou promised to conduct internal research to delve deeper into the matter and accentuated the aptness of arbitration in resolving disputes inherent to real estate sale contracts. He also committed to incorporating arbitration clauses into such contracts.

Citing high-profile TRF (Target Redemption Forward) disputes, Chairman Wu of CAA alleviated apprehensions regarding arbitrator impartiality and independence. He indicated that within CAA-administered arbitrations, arbitrators are mandated to disclose instances of being appointed by either party three or more times within the past three years. Chairman Wu additionally pointed out collaborative efforts with the Real Estate and Investment Association of Taiwan R.O.C and the Real Estate Development Association of Kinmen to promote arbitration's utilization in addressing real estate transaction disputes. CAA, in its pursuit, would undertake a study to tailor arbitration clauses to the distinct requirements of the real estate sector.

During the interaction, Chairman Chou, an alumnus of both Shih Hsin University (SHU) and Chinese Culture University (PCCU), engaged in informal dialogue with CAA Chairman Wu (formerly President of SHU) and Secretary General Lee (formerly President of PCCU) regarding recent developments at the universities.

如您不希望收到本報信息,請點選取消訂閱仲裁報。

If you do not wish to receive this newsletter, please click HERE.